La Embajada y los Consulados estadounidenses en México tienen citas hasta el 2025.

La representación diplomática de Estados Unidos en México está conformada por la Embajada, ubicada en la Ciudad de México, nueve consultados y nueve agencias consulares distribuidos a lo largo y ancho del país. Los consulados están distribuidos en las ciudades fronterizas de Tijuana, Nogales, Ciudad Juárez, Nuevo Laredo y Matamoros; así como en capitales como Hermosillo, Monterrey, Mérida y Guadalajara.

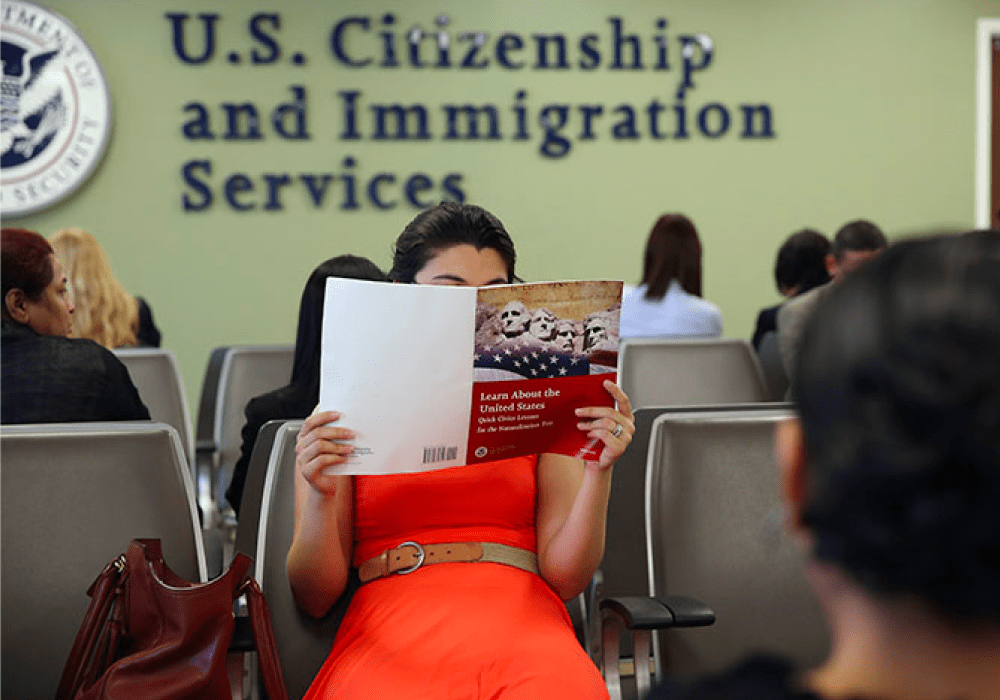

Las funciones de la misión diplomática de Estados Unidos son representar y proteger los intereses de Estados Unidos. Entre sus tareas se encuentra la emisión de visas de diversas categorías para ciudadanos extranjeros. Actualmente, las citas para obtener una visa B1/B2 en 2023 y 2024 se encuentran agotadas en todas las representaciones. Es decir, las siguientes citas disponibles son hasta el año 2025.

No obstante, las fechas corresponden a solicitantes que requieren pasar por la entrevista con las autoridades consulares. Las personas que están exentas de realizar la entrevista, ya sea por renovación de visa o por otras razones, deben esperar tiempos menores.

Puedes consultar más información sobre visas de turista directamente en el sitio del Departamento de Estado: https://travel.state.gov/content/travel/en/us-visas/tourism-visit.html