Recursos y apoyo para encontrar vivienda en un mercado costoso.

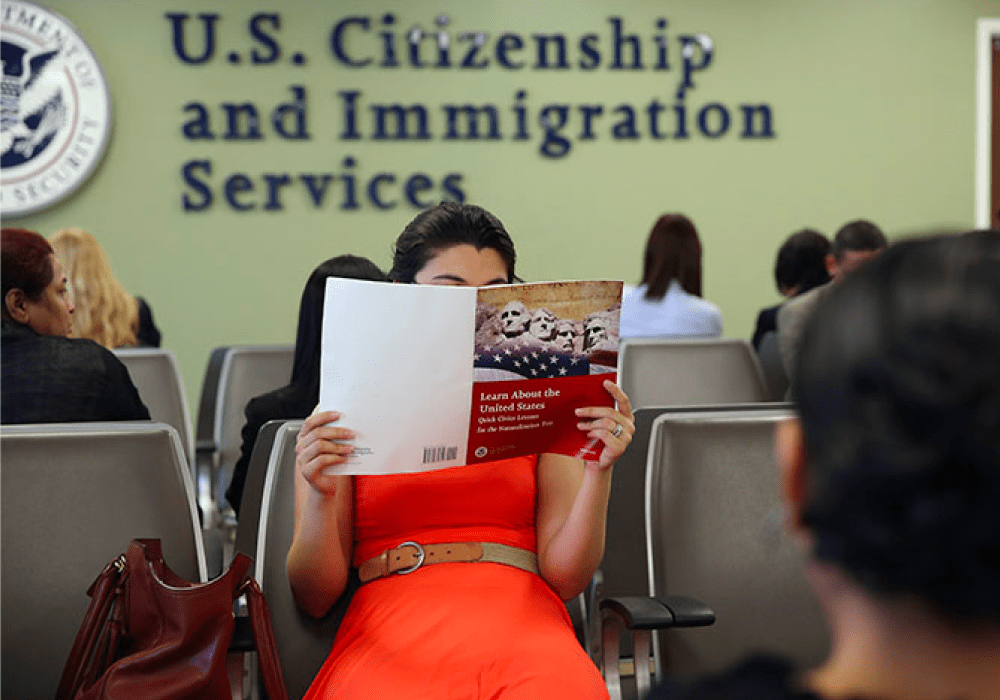

La búsqueda de una vivienda asequible y segura es un desafío constante para muchos inmigrantes en Estados Unidos, especialmente en áreas con altos costos de vida. Sin embargo, existen diversas organizaciones y recursos que pueden asistir a los migrantes en este proceso, proporcionando apoyo y evitando el desplazamiento.

Encontrar un lugar adecuado para vivir puede ser una tarea intimidante, pero no estás solo. Aquí te presentamos algunos recursos y consejos que pueden facilitarte esta búsqueda:

Organizaciones que ofrecen asistencia:

- Coalition for the Homeless: Proporciona asistencia para la búsqueda de vivienda y otros servicios esenciales a individuos y familias en situación de vulnerabilidad.

- National Low Income Housing Coalition (NLIHC): Aboga por políticas que promuevan viviendas asequibles y ofrece recursos y guías útiles para los buscadores de vivienda.

- Catholic Charities USA: Ofrece programas de vivienda y apoyo a inmigrantes y refugiados en diversas comunidades.

Programas de asistencia del gobierno

- Section 8 Housing Choice Voucher Program: Ayuda a familias de bajos ingresos, personas mayores y discapacitados a pagar la renta en viviendas privadas.

- HUD Public Housing: Proporciona viviendas subsidiadas administradas por las autoridades locales de vivienda pública.

Consejos para la búsqueda de vivienda

- Investiga el Mercado Local: Conoce las áreas donde los costos de vida son más accesibles y compara opciones.

- Aprovecha las Redes Comunitarias: Las organizaciones comunitarias pueden ofrecer consejos y referencias valiosas.

- Consulta con un consejero de Vivienda: Existen consejeros especializados en ayudar a los inmigrantes a navegar el proceso de búsqueda de vivienda.

Prevención del desplazamiento

- Conoce tus Derechos: Es crucial estar informado sobre los derechos del inquilino en tu estado.

- Programas de Asistencia Legal: Muchas organizaciones ofrecen servicios legales gratuitos o de bajo costo para inmigrantes que enfrentan desalojos.

Aunque encontrar una vivienda asequible y segura en Estados Unidos puede ser un reto, existen numerosas organizaciones y recursos dedicados a apoyar a los migrantes en este proceso. Aprovechar estos recursos puede marcar una gran diferencia, permitiéndote encontrar un hogar adecuado y estable para ti y tu familia. Recuerda que no estás solo y que hay ayuda disponible para superar estos desafíos.

Si necesitas más información o asistencia personalizada, no dudes en contactar a las organizaciones mencionadas o a otros recursos locales que puedan ofrecer apoyo adicional.