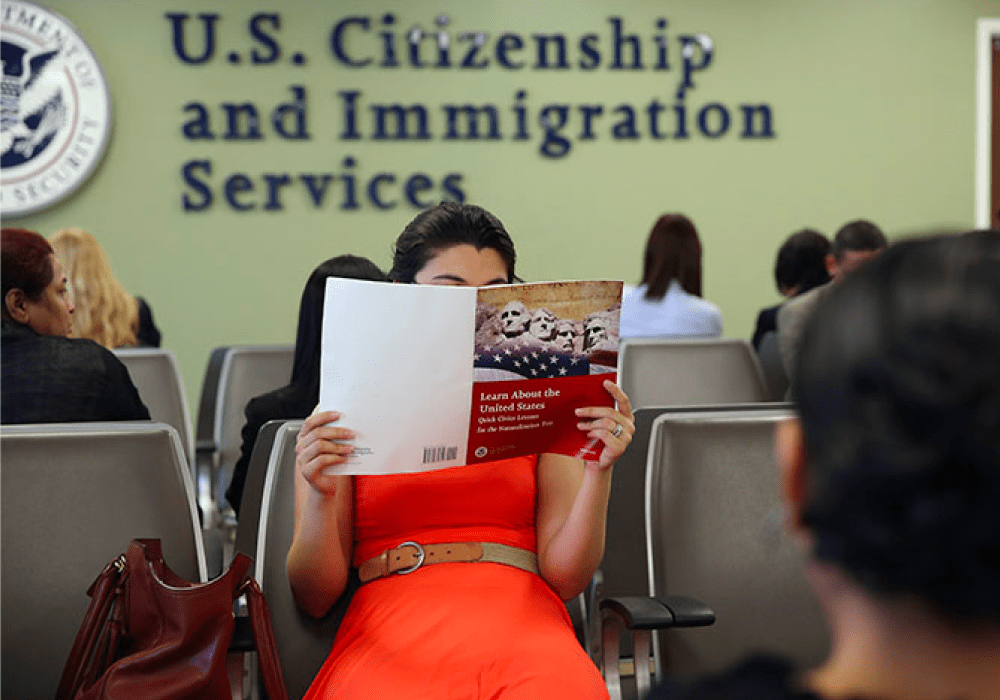

Access to housing is one of the most important strategies for closing wealth gaps between social, racial, and ethnic groups in the United States.

According to a report presented at the Unidos US annual conference, equity in access to housing plays a major role in creating wealth for the Latino community. Home equity accounts for 57.6% of the wealth of Hispanic households. Unidos US showed that between 2016 and 2019 there were more than 800 thousand new Hispanic homeowners and in the same period the median wealth of Latino households increased by 65%, this being the largest increase in households of any demographic group in the country. .

However, Latinos and Latinas face various obstacles to saving for a home, as they face an unequal housing system. As the Unidos US document explains, for decades federal, state and local policies favored the creation of wealth by other demographic groups, leaving African-Americans and Latinos behind.

There are strategies such as housing down payment assistance (DPA), which could help minority groups such as Latinos. A DPA program would provide support for lower monthly home payments. In addition, according to Unidos US, this strategy would be capable of creating 1.32 million home buyers of Latino origin.

For a strategy that seeks to close the racial wealth gap to work, it must be designed to include requirements such as specific eligibility criteria (aimed at ethnic minorities) and have adequate funding. Organizations such as Unidos US have led advocacy efforts to create a national down payment assistance program for first-generation homebuyers. For this they have presented proposals to national state and local organizations, to pressure Congress.

Learn more at the following link: https://www.unidosus.org/publications/2022-unidosus-annual-conference-fact-sheets/